Building the economy

We are building the economy of the future to benefit you today. We’re investing in and connecting our electric vehicle (EV) and EV battery supply chains to create good-paying jobs across the province. EVs and the batteries that power them will be built in Ontario, by Ontario workers.

Unlocking critical minerals and the Ring of Fire

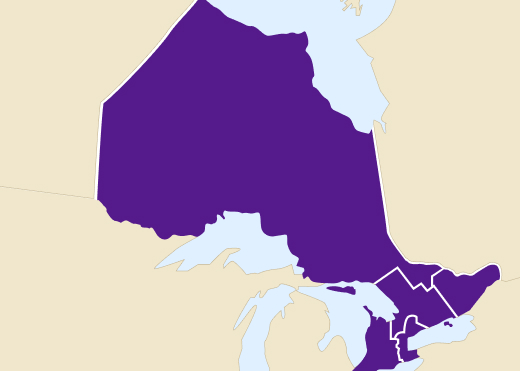

We’re unlocking the economic potential of the Ring of Fire and Ontario’s abundant supply of the critical minerals in the North to produce batteries for electric vehicles.

Training Ontario’s skilled workforce

We’re investing more than $1 billion to train the skilled workforce needed to build Ontario’s economy.

Made-in-Ontario electric vehicles and batteries

We’re connecting mines and minerals from the North with automotive and electric vehicle battery manufacturing in Southern Ontario so that communities across the province benefit.

Ontario’s clean competitive advantage

Invest in clean, green steel

We’re investing in clean steel to enhance our competitive advantage and help meet the demand for low-emissions manufacturing.

Securing Ontario’s clean-energy advantage

The future of our economy will be powered by clean, affordable, made-in-Ontario energy.

Projects and investments

Ontario is securing EV and EV battery investments that are creating and keeping good jobs in communities across the province. Data from October 2020 to March 2023.

17.5 billion

Total investments

13,700

Jobs created and retained

Find more information about our latest announced projects and investments.

Invest in Ontario

Learn how to join a growing number of businesses choosing Ontario.

Start and run a business

Start a business

Learn how to:

- choose your business structure

- register your business name in Ontario

- set up an Ontario business number for business tax purposes

Get started

Get a custom guide

Answer a few simple questions and get a downloadable custom guide to start your business. For example:

- business registration

- getting an HST number

- setting up payroll and benefits

- permits, licensing and insurance

Take our questionnaire

Funding opportunities

Ontario has a number of funds available for entrepreneurs. Depending on the type of business you want to run, you may be eligible for programs and funding:

View a full list of funding opportunities.

Programs by region

Get support to expand or bring business to your community:

Permits and licenses

Find out what permits and licenses are required for your business, based on your location, industry and business activities.

Insurance

Workplace insurance

Find out if you need insurance for wage-loss benefits, medical coverage and support after a work-related injury or illness.

Business insurance

Protect against loss or damage to physical property, or the loss of your business’s ability to operate and generate income.

Workplace rules and regulations

Understand your obligations as a business owner, and the rights and responsibilities of employers and employees in Ontario.

Employment Standards Act

Learn the rules about minimum wage, hours of work limits, termination of employment, job-protected leaves of absence and more.

Occupational Health and Safety Act

Before starting specialized work (work that involves a trench, diving, window cleaning, tunneling and asbestos removal), you must file a work notice to protect the health and safety of your workers.

Learn everyone’s rights and duties in the workplace, and how to deal with workplace hazards.

Accessibility laws

Laws and standards are in place to make Ontario more inclusive for everyone.

taxes

In order to file business taxes and deduct payroll, you need a Business Number (BN). If you don’t have one already, learn how you can get a Business Number.

Harmonized Sales Tax

Learn more about the Harmonized Sales Tax (HST), see what items are subject to a point-of-sale rebate, and claim a rebate.

File taxes for free

Manage your tax account, returns, payments, and refunds for free online at ONT-TAXS.

Export and trade

Grow your business by selling products outside Ontario and Canada.

Events

Search upcoming international trade programs and events by sector and market region. Find trade missions, exhibitions, seminars, and workshops for Ontario businesses looking to export outside Canada.

Resources

Explore resources to help grow your exporting business such as market research, funding support, and insurance.

Indigenous resources

Get support

Close a business

Learn about how to close a business including succession planning, selling a business, closing accounts, and declaring bankruptcy.

Investment needs

Talk to a business consultant at Invest Ontario for your investment needs.

Join the “Ontario Made” program

Register as a manufacturer or retailer with Ontario Made. You’ll be listed in their business directory and get access to promotional materials, such as the “Ontario Made” logo.

Find a Small Business Enterprise Center near you

They provide advisory services and workshops that equip businesses with foundational entrepreneurship skills and continue support, including training, mentorship and grant opportunities.

See a full list of locations.

Help us better serve entrepreneurs and businesses

We value your feedback. Please take 2 minutes to let us know how we can improve our business and service information to best support you.