Content

This is the susceptibility of an account balance or class of transaction to material misstatement either individually or when aggregated with misstatement in other balances or classes assuming that there were no related internal controls. Environmental, social, and governance topics, known collectively as ESG, and reporting on such issues are likely to grow dramatically in importance in 2022 and will also likely be heightened risk areas in the coming months. Last March, the Securities and Exchange Commission announced the creation of a Climate and ESG Task Force in the Division of Enforcement. Getting those processes up to par and ensuring reliability and accuracy in ESG reporting in the coming months could be a mammoth undertaking for internal audit.

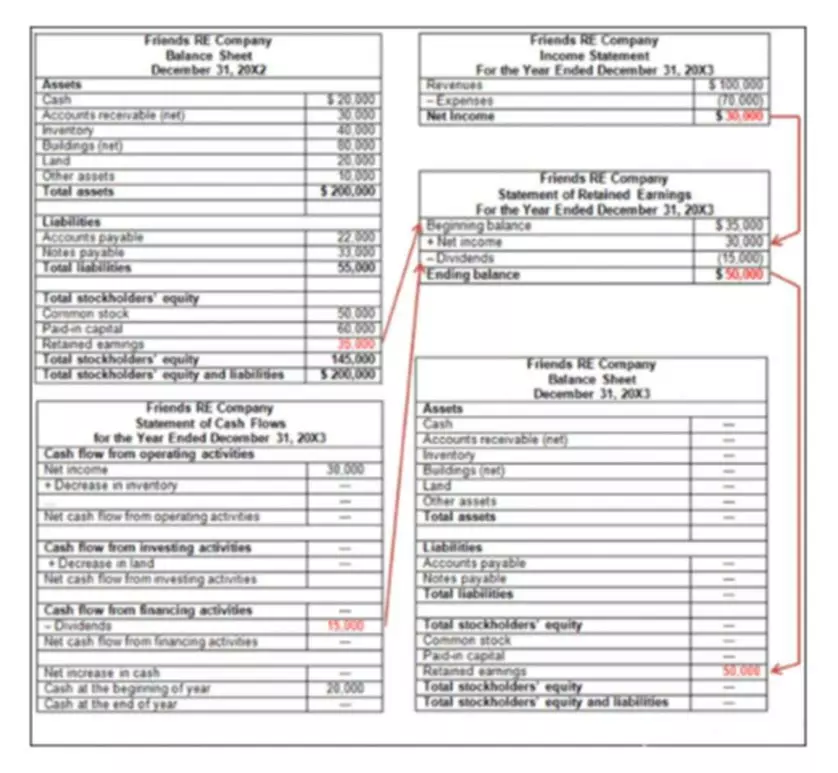

Companies do find themselves in trouble, relying on inaccurate numbers as reported by employees. Companies must have an internal control mechanism adequate for detecting and preventing incorrect data that may lead to fraud and error.

What are the 8 sources of risk?

This type of risk represents a worst-case scenario because all internal controls in place have nonetheless failed. The auditor must enquire from management and those charged with governance about the internal controls as well as how financial statements are prepared to well understand the client entity. Audit risk ultimately refers to the risk that an CPA firm issues an inaccurate opinion of an organization’s internal controls.

- She is Certified in Risk and Information Systems Control and obtained a Bachelor of Science in Business Administration, Finance, from the University of Colorado at Boulder.

- This requires internal auditors to have a working knowledge of basic concepts, frameworks, tools, and techniques related to risk and risk management.

- Risk-based auditing ensures that the internal audit activity is focusing its efforts on providing assurance and advisory services related to the organization’s top risks.

- This course is designed for new internal auditors and internal auditors who are new to a risk-based approach to internal auditing.

- Auditors examine inherently and control risks in a bid to gain a clear understanding of the company as well as the environment they are dealing with.

In the process of preparing the financial statements, irregularities often occur, leading to what is termed as audit risk. Audit risk is the risk that an audit opinion is incorrectly issued, and it has come from a leak of internal control over financial reporting, poor audit quality, and inherent risks.

Risk of Material Misstatement

This past year was a busy one for those involved in the audit risk model assessment process, such as internal auditors, risk management executives, compliance officers, and others who have responsibility for assurance and risk management. After the COVID-19 pandemic and its disruptive effects caught nearly every company off guard, they set out to rethink the risk assessment process and many companies have overhauled such systems this year. They are working to make risk assessments more accurate, more encumbering, and more responsive to the quickly changing risk environment of a dynamic and rapidly evolving business world. Similarly, to avoid all three types of audit risks, several components must be dealt with. For starters, intense planning and strategizing in every department and every process of auditing must come into play.

- This risk can have a bearing on shareholders, creditors, and prospective investors.

- Management discussion and analysis (MD&A) is a section of a company’s annual report in which management discusses numerous aspects of the company, both past and present.

- How will the level of control risk (high risk vs. low risk) affect interim testing?

- When doing this, the Company and its auditor should consider both inherent risk and control risk.